Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central Integration Suite

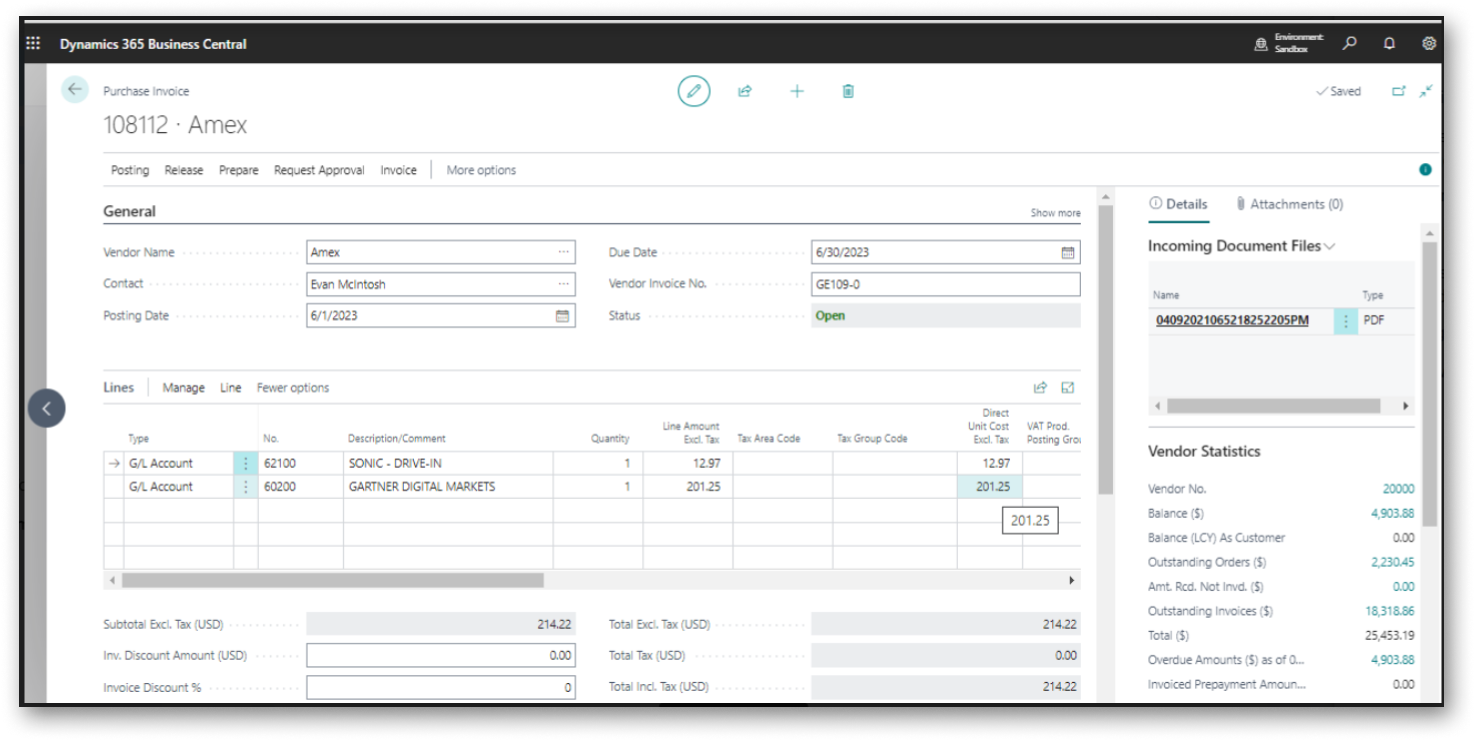

Integration with Purchase Invoice

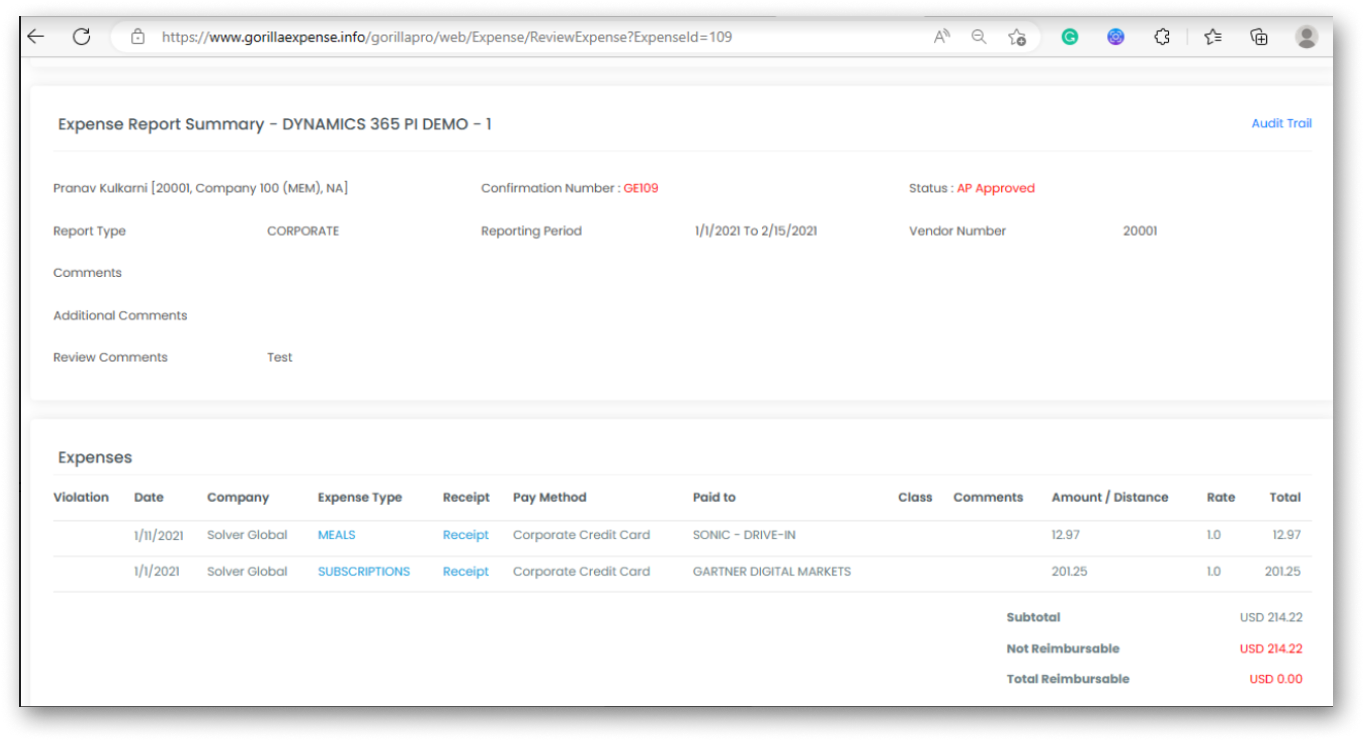

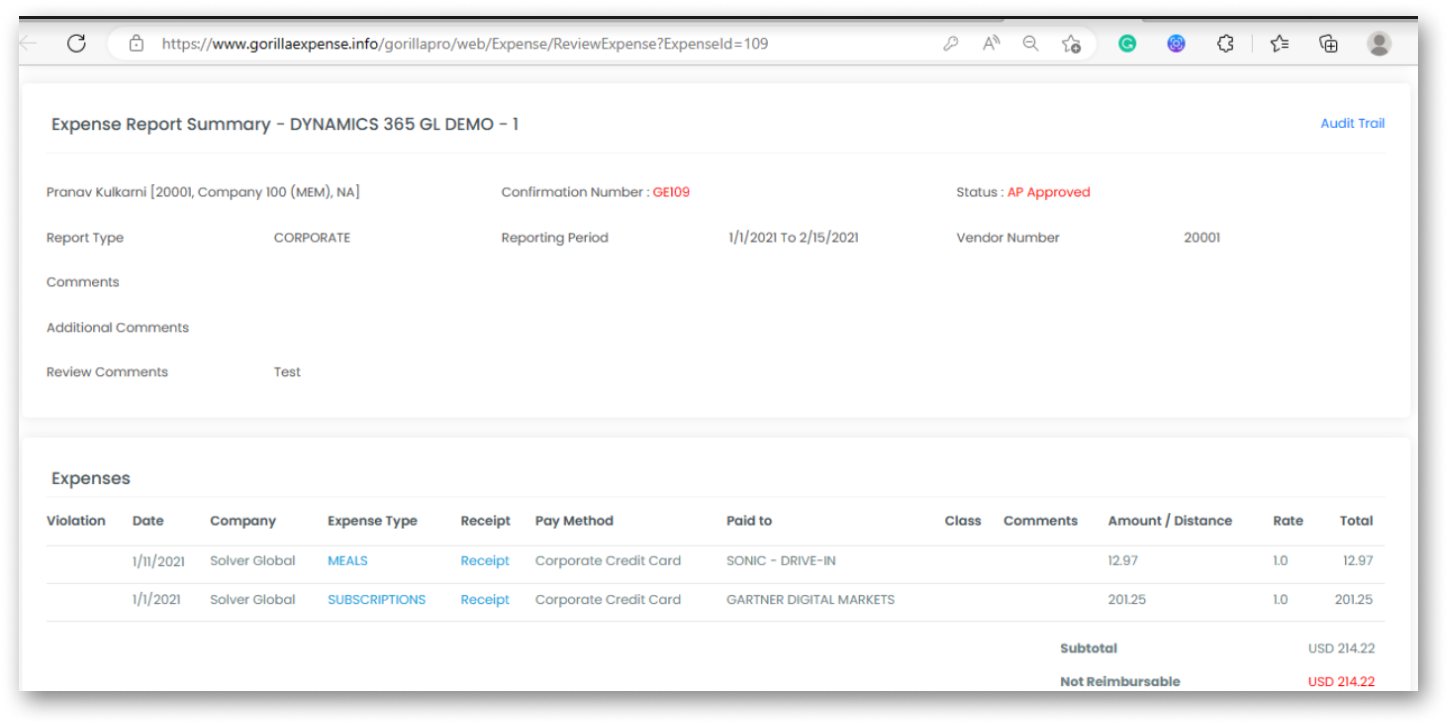

Gorilla Expense seamlessly integrates with Microsoft Dynamics 365, allowing expense reports to be posted directly to the Payables – Purchase Invoice screen. With our streamlined integration, expense reports are transferred smoothly, creating invoices in Dynamics 365 Business Central. With high configurability and support for out-of-the-box dimensions, Gorilla Expense is the ideal solution for streamlined expense management.

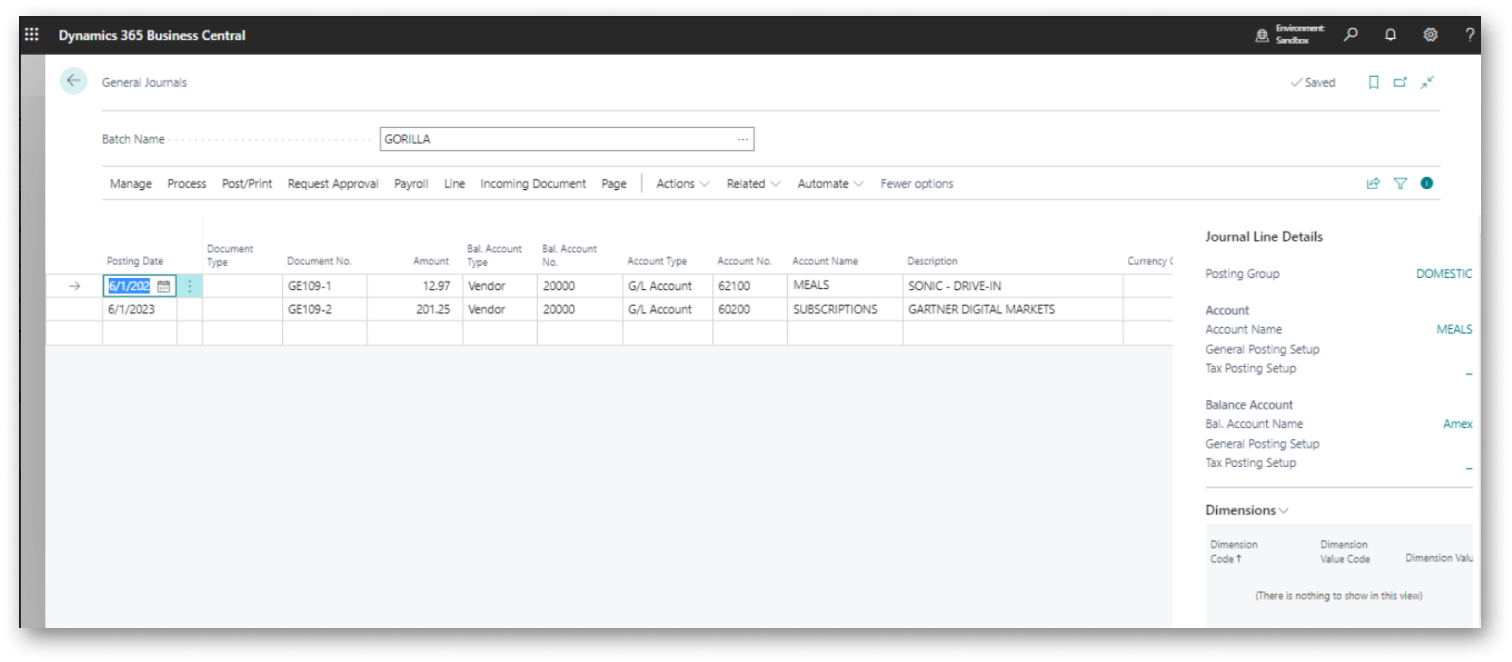

Integrate with General Ledger

Besides the AP integration, Gorilla Expense also provides a streamlined solution for expense report integration into the General Ledger of Dynamics 365. Using our web application, admin users can fetch “Manager Approved” expenses and send them to Dynamics 365 on-demand or automatically. Our secure integration architecture eliminates the need for complex infrastructure modifications, ensuring simplicity and efficiency.

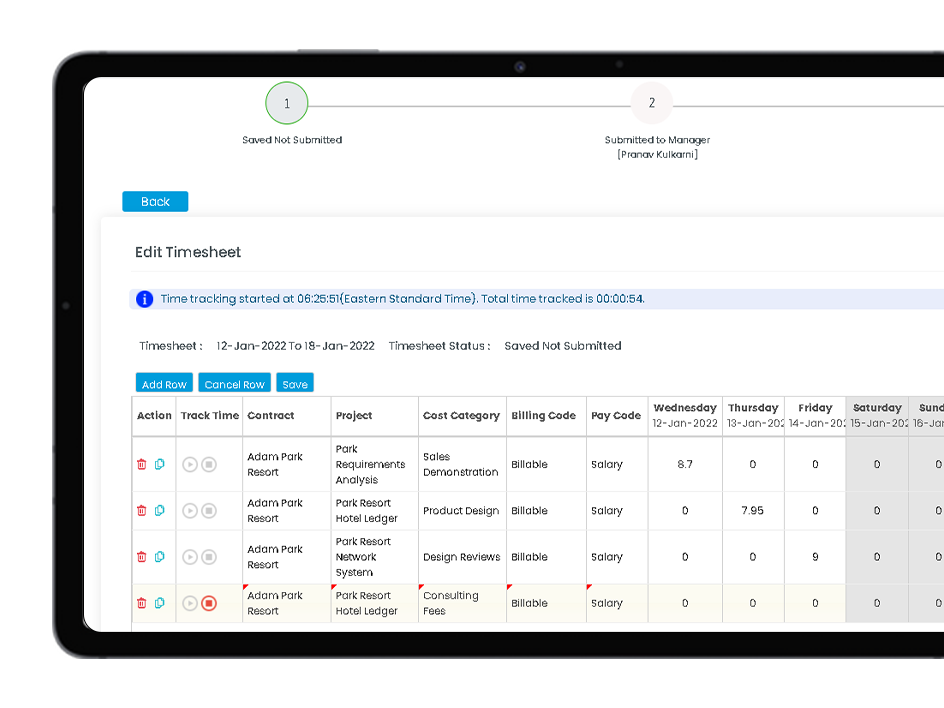

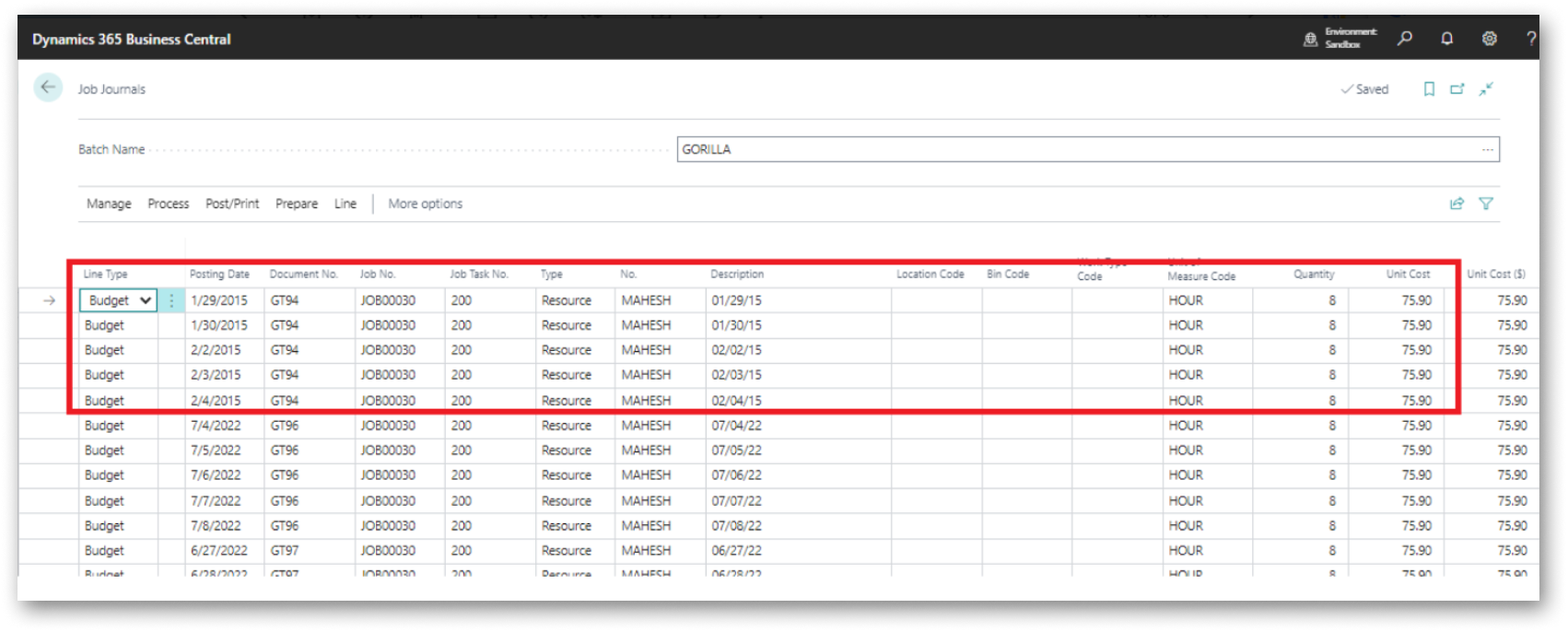

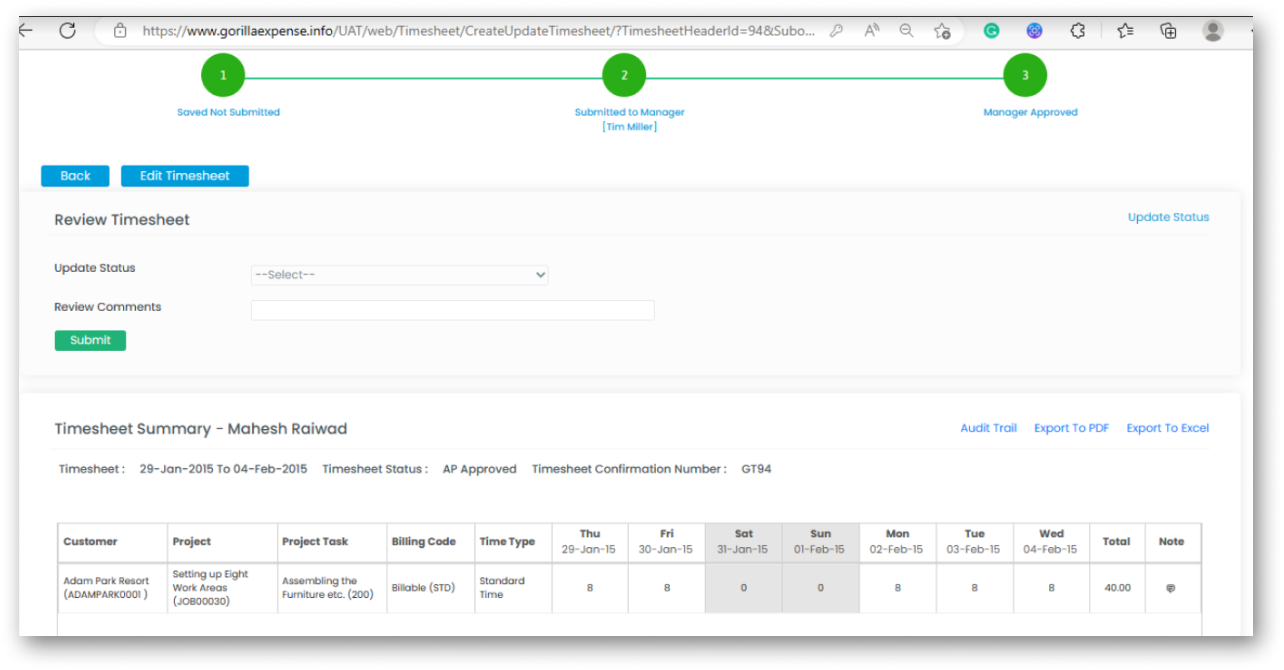

Streamlined Timesheet Integration with Job Journals

Gorilla Expense seamlessly integrates with Microsoft Dynamics 365, enabling the posting of timesheet data to Job Journals. We enable Admin users to fetch Manager Approved timesheets and send them to Dynamics 365 via the web application.

Real-Time Master Data Sync

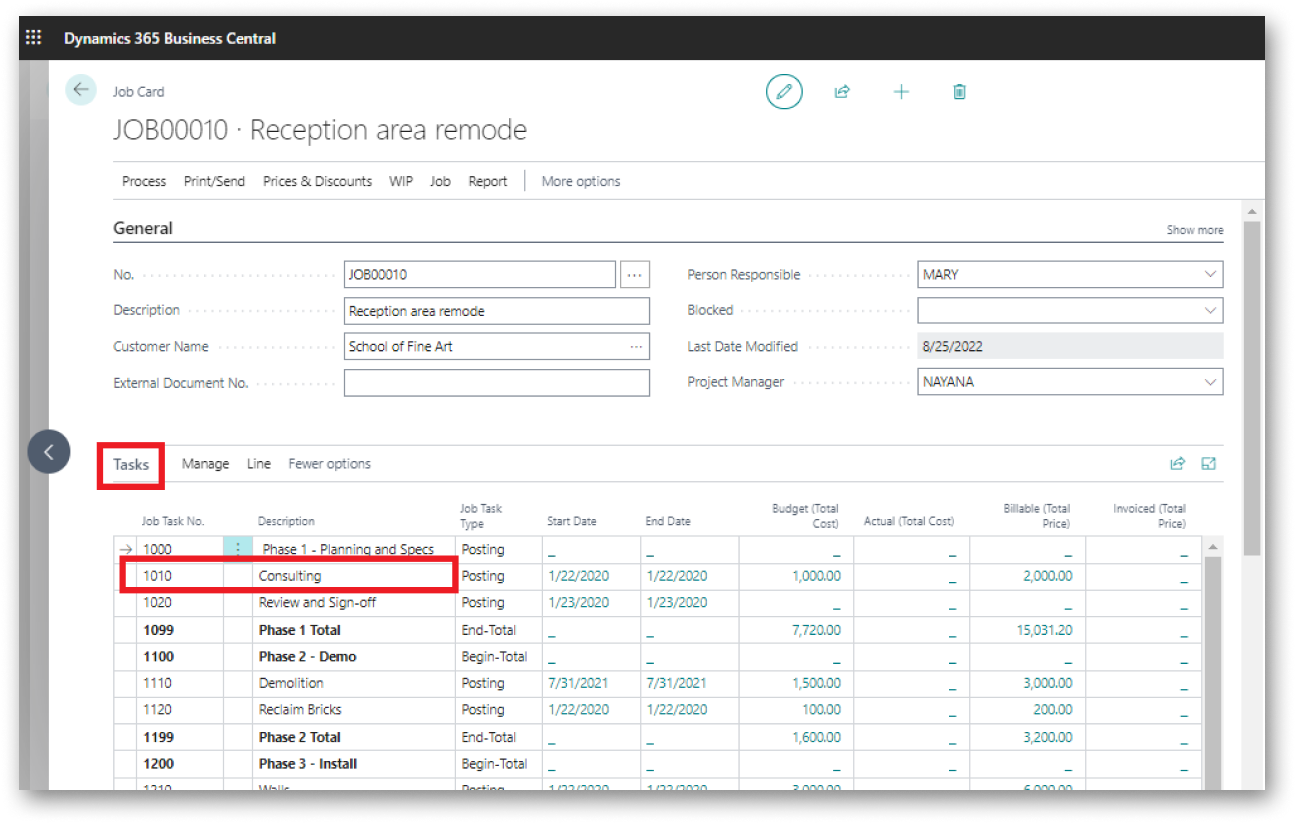

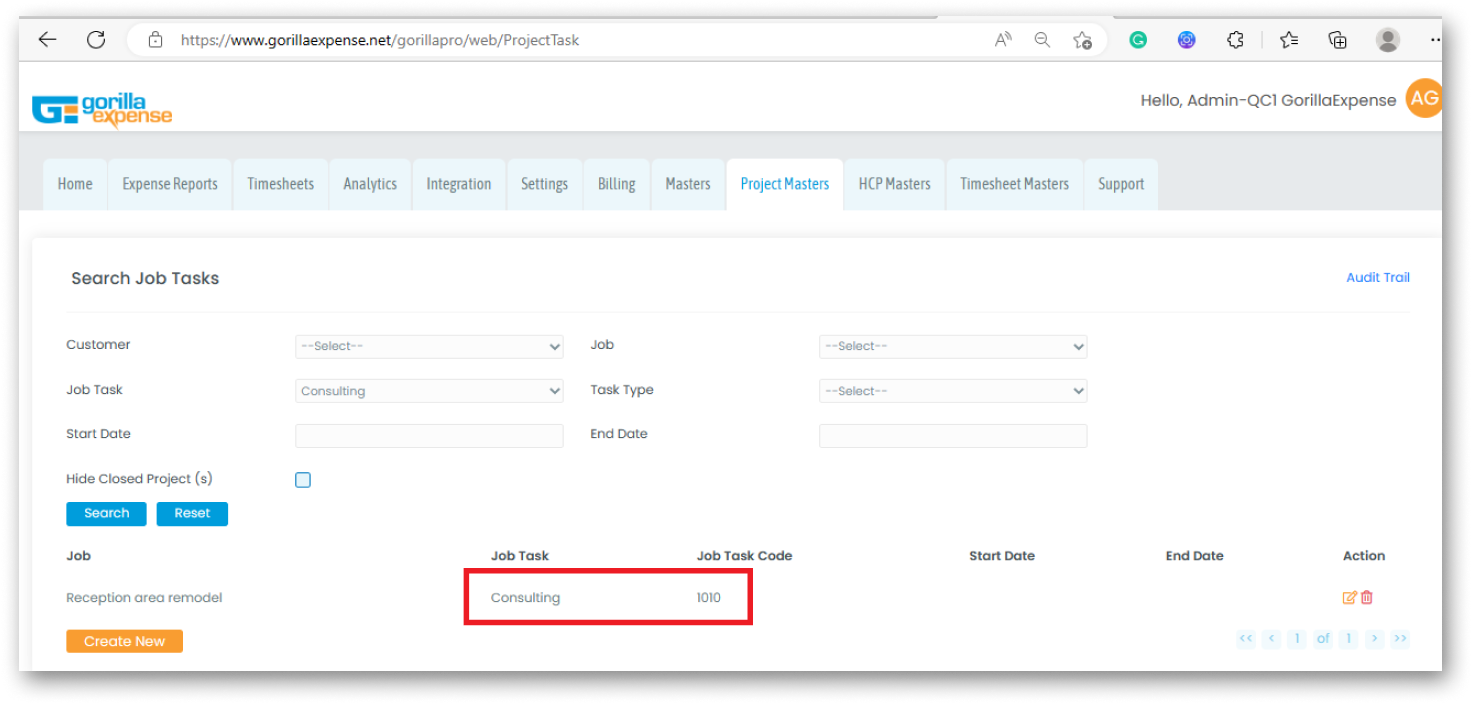

The master data we are synching is:

- Customers

- Jobs

- Tasks

- Job Resources

- Job Manager

- Vendor Sync

- Employee Sync

Take advantage of close to real-time sync of frequently changing master data like jobs, task.

Gorilla Expense X Solver Global for AP Modules

Gorilla Expense syncs with Dynamics 365 Business Central’s AP module through Solver Global’s QuickStart deployment. Pre-mapped fields ensure accurate data import, while Solver’s AP reports provide direct access to related Gorilla Expense transaction screens. Leverage pre-defined AP reports from Solver’s Marketplace and create custom Gorilla Expense AP reports in just one day with the QuickStart deployment.

Gorilla Expense X Binary Stream Enabling Multi-Entity Management and AP Automation

Tap into the power of Multi-Entity Management while automating invoicing and expense approvals within the familiar Microsoft interface. Automate invoicing and expense approvals with 360-degree visibility, real-time reporting, and centralized transaction processing. Also benefit from centralized transaction processing, EU tax tools, and on-the-go approval capabilities.

Find out more about the Gorilla Expense integration

with Microsoft Dynamics 365 Business Central

teams and loved by

all employees

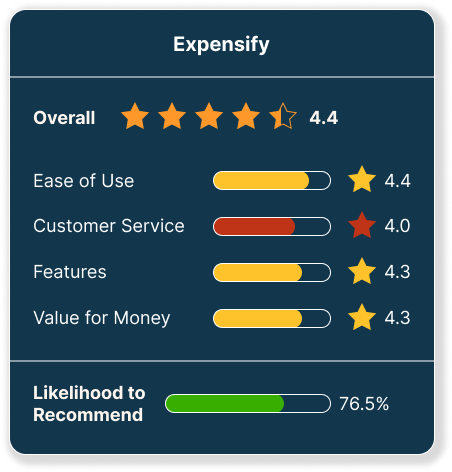

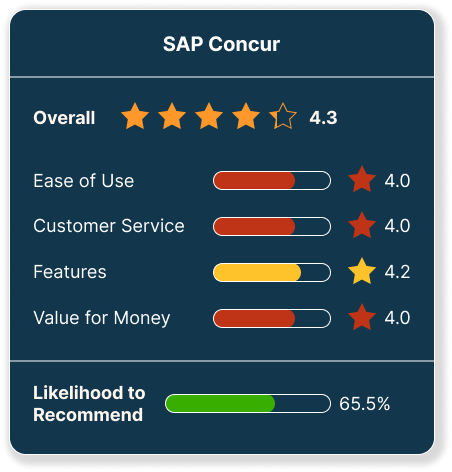

Smarter Spending for Smart Decision-Makers

Just ask our clients!

Approved

ApprovedMost likely to be recommended with

the highest rating of 77.8%

users in 40+ Countries

across

7 continents

every year

compliance

reduces spending

by 5%

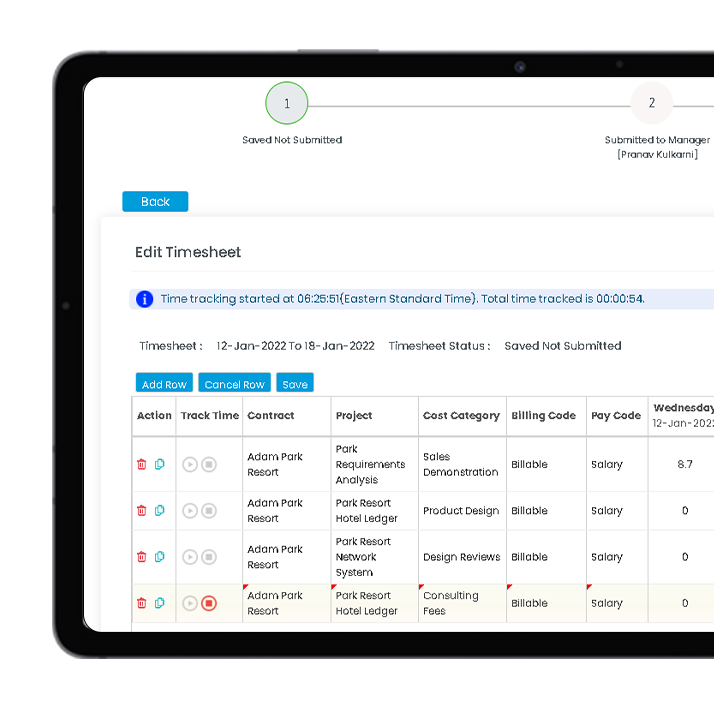

Streamline Expense

Reporting Process

Seamlessly to Time Tracking

With a built-in reporting module, multi-level approval, and electronic routing, our 100% online solution ensures increased visibility all across the organisation while reducing cost.

Eliminate tedious manual timesheet

processing with an easy, powerful &

configurable solution.

Management

Seamlessly to

Time Tracking

With a built-in reporting module,

multi-level approval, and electronic

routing, our 100% online solution

ensures increased visibility all across

the organisation while reducing cost.

Eliminate tedious manual timesheet

processing with an easy, powerful &

configurable solution.